Responsible investment

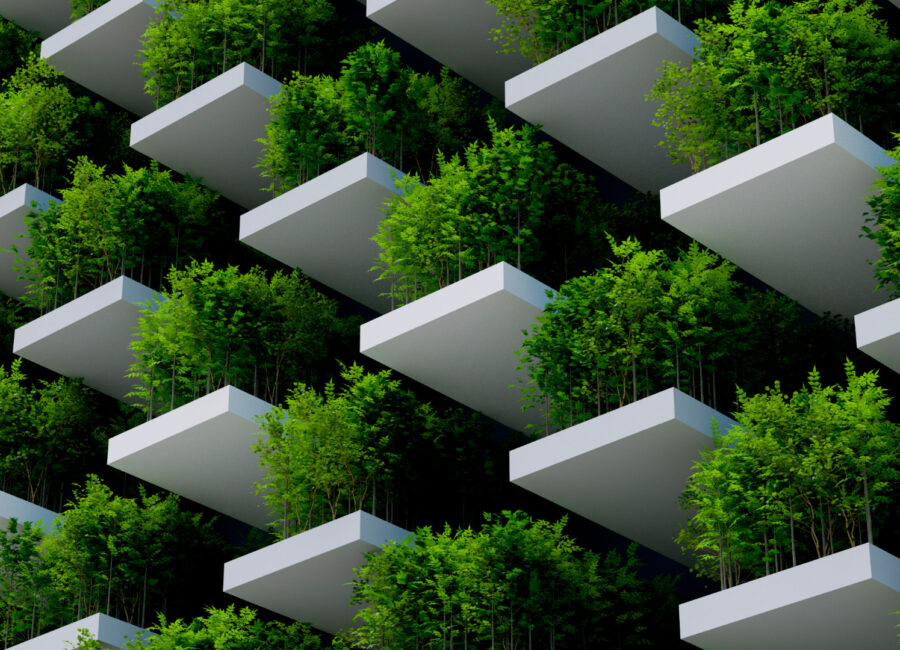

Responsible investment, positive and sustainable impact

As growing investors focused on expansion, we support companies during the crucial phases of their development. This position enables us to drive positive change, influencing not only the bottom line, but also the social and environmental context in which we operate.

We contribute to

achieving the SDGs

We believe that active management of environmental, social and good governance factors contributes to the creation of value for our portfolio companies, generating a positive contribution to the Sustainable Development Goals (SDGs).

We are committed to a sustainable,

responsible and high-impact model

Contributing to decarbonising the economy

We believe that active management of environmental, social and good governance factors contributes to the creation of value for our portfolio companies, generating a positive contribution to the Sustainable Development Goals.

Positively influencing society and communities

With our growth capital, we help companies expand, generate wealth and contribute positively to the communities in which we operate. Growth translates into greater community prosperity.

Better governance and greater resilience

A solid structure, clear accountability, efficient decision-making and diligent performance underpin long-term viability.

We integrate ESG factors into the investment process

1. Pre-investment

We operate with strict criteria and restrictions on sectors contrary to ethical and ESG principles.

We incorporate ESG issues into the analysis and investment decision-making processes.

We conduct ESG due diligence to identify red flags and opportunities.

We validate the company’s ESG policies and programmes for sustainable value creation.

2. During the investment

We actively participate in discussions on ESG issues in the boards of directors of the companies in our portfolio.

We provide senior ESG advisers to oversee the activity of our portfolio companies.

We regularly review the policies developed.

We establish key performance indicators (KPIs) and we continuously monitor them.

3. Divestment

We achieve sustainable governance structures.

ESG issues as part of the due diligence of the buyer.

We operate beyond ESG regulatory frameworks, taking a proactive approach to sustainability that goes beyond required compliance.

Disclosures on sustainability information

Diana Capital S.G.E.I.C., S.A. is subject to European Union Regulation (EU) 2019/2088 on sustainability‐related disclosures in the financial services sector.

| General disclosure obligations at asset manager level | |

| Information on financial products that promote environmental or social characteristics | |

| Statement of the principal adverse impacts of investment decisions on sustainability factor | |

| Responsible investment policy |

Case studies

GRUPO LAPPÍ

It uses 100% sustainable materials, non-toxic inks and varnishes, and it was the pioneer in its sector in recording its carbon footprint.

GOCCO

It manufactures garments using natural and/or recycled fibres, monofibres, which are easier to recycle and always with the aim of increasing the durability of the garments. It has also progressively minimised the impact of its sourcing process on the environment.

ESTANDA

Its raw material is recycled scrap and more than 92% of its sands are recycled. All its energy sources are renewable and it has improved the quality of the manufacturing process, reducing waste by 70%, as well as managing waste, reducing it from 10,000 tonnes to 3,000 tonnes.

We are members of